Dental / Vision

DENTAL BENEFITS

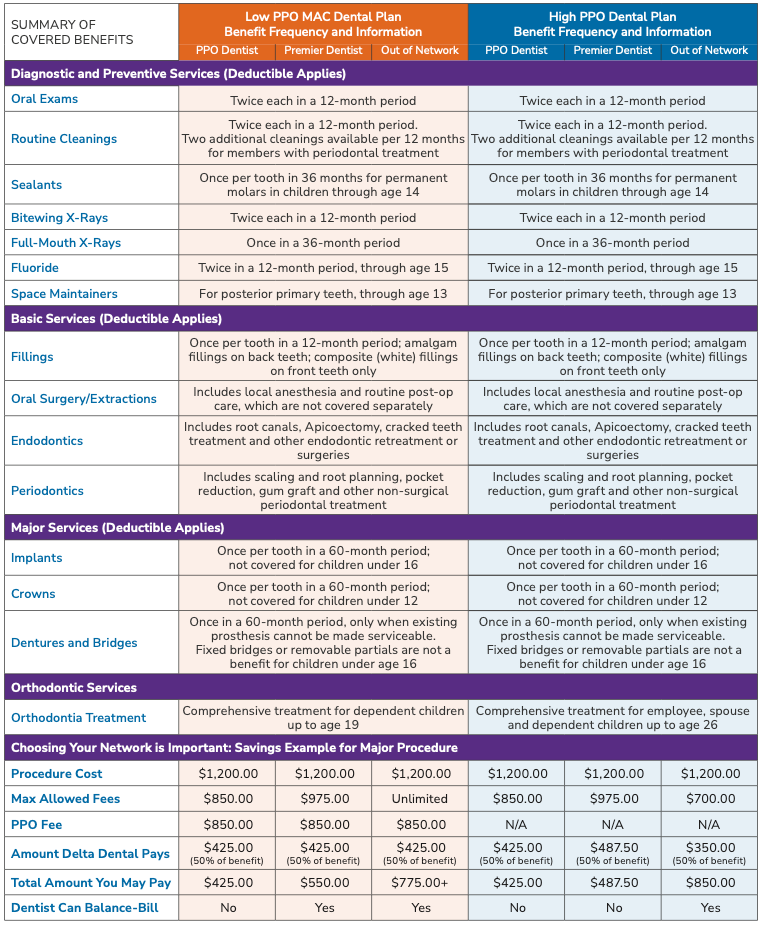

Denver Health offers two dental insurance plan options through Delta Dental of Colorado.

The Low and High plans offer in- and out-of-network benefits, providing you the freedom to choose any provider.

Both plans offer a three-tier network structure. You will receive the greatest discounts and lowest out-of-pocket costs when you choose to see a PPO network provider.

To find a provider, visit deltadentalco.com/dentist-search.html and under “Plans participating in,” select Delta Dental PPO Plus Premier.

Maximum Allowable Charge (MAC): Claims for out-of-network providers are paid according to a PPO fee schedule (the maximum amount Delta Dental will pay), meaning you will pay more when you see a non-PPO provider.

The table below summarizes key features of the dental plans. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) Restrictions apply for children. (2) Orthodontia services do not count toward your annual calendar-year maximum.

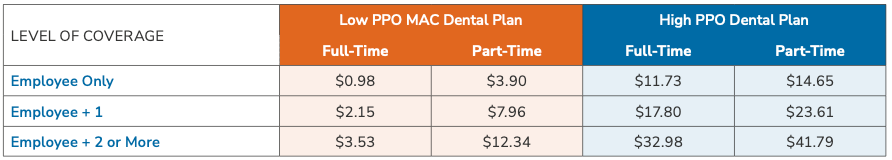

DENTAL COSTS

Listed below are the biweekly costs (24 pay periods) for dental insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

Full-time benefits eligible: 0.75 to 1.0 FTE

Part-time benefits eligible: 0.50 to 0.74 FTE

Note: Payment examples above are for illustration purposes only. Example assumes deductible has been met.

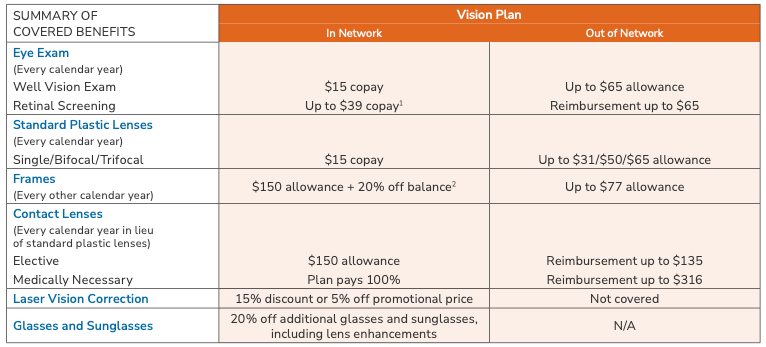

VISION BENEFITS

Denver Health offers a vision insurance plan through VSP.

You have the freedom to choose any vision provider. However, you will maximize the plan benefits when you choose a network provider.

The table below summarizes key features of the vision plan. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) $0 for members with Type 1 or 2 diabetes when in-network, and up to $39 for all other members when in-network. (2) $80 allowance at Costco or Walmart.

Diabetic Eye Care Plus Program

As part of your VSP vision plan, you have access to additional services and savings through the Diabetic Eye Care Plus program. Plan members with diabetes receive retinal screenings AT NO COST. Additional exams and services are available for members with diabetic eye disease, glaucoma, or age-related macular degeneration. Limitations and coordination with your medical coverage may apply. Visit vsp.com for details.

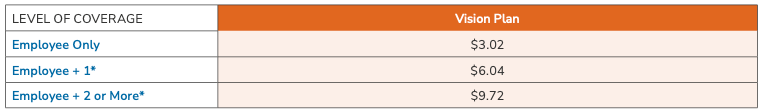

VISION COSTS

Listed below are the biweekly costs (24 pay periods) for vision insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

*Please note: Frame allowance will apply every other calendar year, even if your covered dependent changes.