Critical Illness and Accident

Voluntary Accident Insurance

Administered by Dearborn Life / BlueCross BlueShield of Texas Ancillary

Accidents can happen. Your income shouldn’t take the fall.

Accident insurance can help you pay for injuries that occur on or off the job—whether common or severe. This option will pay a lump-sum benefit directly to you if you experience an injury from a covered accident. For a full list of covered benefits, refer to the policy/certificate.

If you enroll now, you are guaranteed base coverage without having to answer any medical questions. You’ll receive 24 hour coverage and your benefit will pay a lump-sum directly to you in the event of a covered accident.

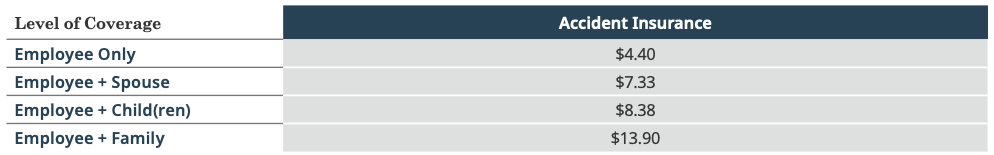

Accident Insurance Costs

Listed below are the biweekly costs for voluntary accident insurance.

Voluntary Critical Illness Insurance

Administered by Dearborn Life / BlueCross BlueShield of Texas Ancillary

Prepare for the unexpected. A severe illness can cause extra expenses that can quickly add up.

Nations Best Holdings, LLC. provides all active, full-time employees the option to purchase critical illness insurance through BlueCross BlueShield of Texas. Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

- Employee: $5,000 up to $20,000—guarantee issue: $20,000

- Spouse: 50% of employees election—guarantee issue: $10,000

- Dependent children: 50% of employees election—guarantee issue: $10,000

- Health screening benefit: $50 per calendar year

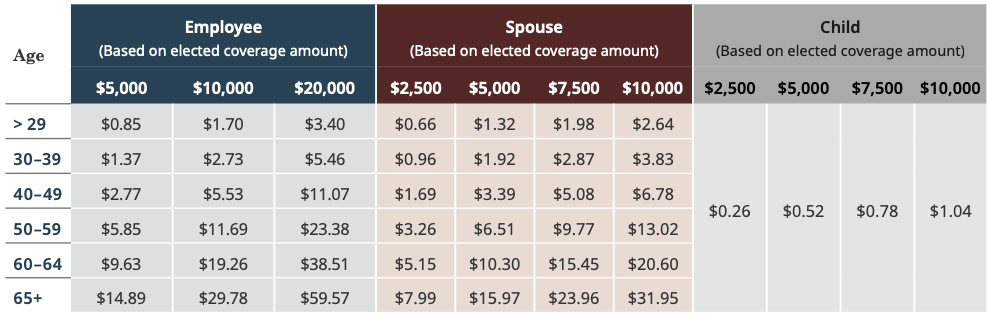

Critical Illness Insurance Costs

Listed below are the biweekly costs for critical illness insurance. You must elect coverage for yourself in order to cover your spouse and/or dependent children.

Note: This Premium Cost Chart is for illustrative purposes only; your premium cost may be slightly higher or lower due to rounding. This piece is intended to provide only a brief summary of the type of policy and insurance coverage advertised. The policy has exclusions, conditions, limitations, and reduction of benefits and/or terms under which the policy may be continued or discontinued. Refer to your certificate for complete details and limitations of coverage. The policy may be canceled by the insurer at any time. The insurer reserves the right to change premium rates, but not more than once in a 12-month period.

Resources

OPEN ENROLLMENT FOR 2024-2025 BENEFITS BEGINS ON 1/29 AND ENDS ON 2/15.

You have three ways to enroll!

- Call 866-430-3009 Monday - Friday from 7 a.m. to 7 p.m. CST during your enrollment eligibility period. Benefits counselors are ready to assist you.

- Schedule an appointment below with a benefits counselor during the enrollment period.

- Self-enroll by registering as a New User here: https://workforcenow.adp.com