Life and AD&D insurance

Supplemental life and AD&D insurance

Depending on your personal situation, basic life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, Rise Broadband offers you the option to purchase supplemental coverage through Sun Life. Use the calculator here to find the right amount for you.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to 40% at age 70, 25% at age 75, and to 15% at age 80.

- Employee: $10,000 increments up to $500,000 or 5x annual salary, whichever is less—guarantee issue: $150,000

- Spouse: $5,000 increments up to $250,000 or 50% of the employee’s election, whichever is less—

guarantee issue: $50,000; Coverage ends when you turn 70 - Dependent children: 14 days to 6 months: $1,000; 6 months to age 26: $1,000 increments up to $10,000— guarantee issue: $10,000

Accident insurance

Rise Broadband provides you the option to purchase accident insurance through Sun Life.

Accident insurance helps protect against the financial burden that accident-related costs can create. This means you will have added financial resources to help with expenses incurred due to an injury, ongoing living expenses, or any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident and pre-ex which is none.

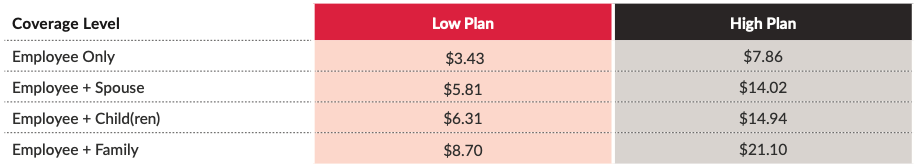

Accident insurance costs

Listed below are the biweekly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Critical illness insurance

Rise Broadband provides you the option to purchase critical illness insurance through Sun Life.

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

- Employee: $10,000 increments up to $40,000

- Spouse: $10,000 increments up to $40,000, not to exceed employee's election

- Dependent children: Birth to age 26: $5,000 increments up to $20,000, not to exceed employee's election

- Pre-existing condition exclusion: None

Rates are age-banded per $10,000 of coverage, please see ADP for your cost.

Note: The health screening benefit is no longer part of critical illness insurance.

Hospital indemnity insurance

Rise Broadband provides you the option to purchase hospital indemnity insurance through Sun Life.

Hospital indemnity insurance can help you and your loved ones have additional financial protection in the case of a hospitalization. Sun Life hospital indemnity insurance pays benefits for hospitalizations resulting from a covered injury or illness. Coverage continues after the first hospitalization, to help you have protection for future hospital stays.

Benefits include:

- First day hospital confinement benefit: Low Plan—$1,000 per day; High Plan—$2,000 per day

- Daily hospital confinement benefit: Low Plan—$100 per day up to 30 days; High Plan—$200 per day up to 30 days

- Hospital intensive care benefit: Low Plan—$100 per day up to 30 days; High Plan—$200 per day up to 30 days

- Pre-ex: None

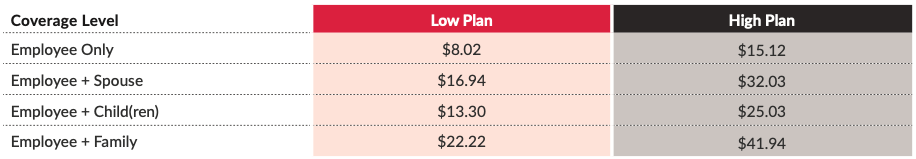

Hospital indemnity insurance costs

Listed below are the biweekly costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Legal plan

Rise Broadband offers you the opportunity to purchase a legal plan through ARAG.

When you enroll in an ARAG legal plan, you gain access to a broad network of over 15,000 licensed attorneys and DIY Docs to create any of 350+ legally valid documents, and you'll save money on attorney fees when you work with a network attorney. Learn more about the benefits of a legal plan here.

ARAG's UltimateAdvisor legal plan includes a broad range of coverage and services, including:

- Wills, trusts, and estate planning

- Adoption and guardianship

- Student loan debt

- Real estate and home ownership

- Traffic tickets and license suspension

- Disputes with a landlord and eviction

- Small claims court

- Bankruptcy and debt collection

- Consumer protection (auto, home, and more)

- Tax audit and collection

- Divorce

- Personal property disputes

- Educational articles, videos, and guidebooks on financial and legal situations

You also have access to exclusive diversity and inclusion benefits including:

- Domestic partnership agreements

- Hospital visitation authorization and funeral directives

- Gender identifier and name change assistance

- Reduced fees on surrogacy agreements, child care authorization, and discrimination issues

The cost for the UltimateAdvisor legal plan is $20.75 per month. For any legal matters not covered, you will be eligible to receive at least 25% off the network attorney’s normal rate.

For more information, visit araglegal.com/plans (access code: 18875rb) or call 800-247-4184, Monday–Friday, 7 a.m. to 20 7 p.m. CT. Or download the ARAG Legal app to access your legal documents and an attorney on the go.

Pet insurance

Rise Broadband provides you the option to purchase pet insurance through Pets Best.

Pet insurance reimburses you for vet bills when your pet is sick or injured, to help take the financial worry out of vet visits.

- Get cash back fast! Pets Best processes most claims in five days or less.

- Optional direct deposit and direct vet pay options.

- Use any veterinarian—including specialty and emergency clinics.

- Optional coverage for routine care.

- Free 24/7 veterinary helpline.

Choose and customize a plan with deductible and reimbursement levels that meet your needs. For questions or enrollment assistance, call 888-984-8700. (Use referral code: RBPETS if calling to enroll.) Please note: This benefit cannot be deducted from your paycheck.