Cigna | 1-800-754-3207 | cigna.com

The City of Portland is committed to providing employees with options to guard against life’s unexpected illnesses and injuries and partnered with Cigna Healthcare to offer Critical Illness, Accidental Injury, and Hospital Care Insurance. These benefits are 100% employee paid and are portable. This means you can take the coverage with you if you leave the City of Portland.

Critical illness insurance

Being diagnosed with a critical illness is hard enough, but you should not have to worry about how it impacts your finances as well. That’s why having Cigna Healthcare Critical Illness insurance is so important.

What It Is:

A cash benefit paid directly to you when you are diagnosed with a covered illness, such as a heart attack or stroke. This video explains the benefit in more detail.

Benefit Example:

Coverage: Marco enrolled in $10,000 worth of coverage

Situation: Marco had a heart attack while raking leaves2

Marco’s Covered Benefit: heart attack diagnosis

Critical Illness Benefit: $10,000 paid directly to Marco

Critical Illness premiums are provided here and vary according to your age and level of coverage you select: $5,000, $10,000, $20,000, or $30,000.

Accidental Injury Insurance

No one can protect you from unexpected accidents or injuries. Accidents happen every two (2) seconds at home and every nine (9) seconds on the road. Accidental Injury Insurance pays an after tax, lump sum benefit directly to you to help with expenses. Examples of covered incidents include hospitalizations, broken bones, and certain surgeries. Cigna Healthcare Accidental Injury insurance offers coverage that can help you recover physically, emotionally, and financially.

What It Is:

A cash benefit paid directly to you when you face an unexpected, covered accident, such as an ankle sprain or arm fracture. This video explains the benefit in more detail.

Benefit Example:

Coverage: Chloe elected Accidental Injury Insurance

Situation: Chloe broke her leg playing soccer2

Chloe’s Covered Benefits:

- Doctor’s office visit

- Diagnostic exam (X-ray)

- Repaired fracture

- Physical therapy sessions

Accidental Injury Benefit: $1,200 paid directly to Chloe

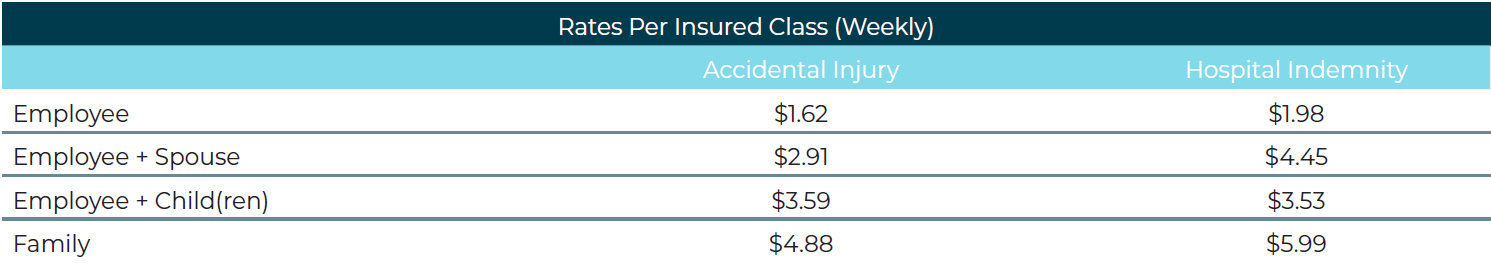

Accidental Injury Premiums:

Costs are subject to change. Actual per pay period premiums may differ slightly due to rounding.

Hospital Care Insurance

A hospital stay can happen at any time, and can add up quickly — medical bills; travel, food and lodging costs; plus, the day to-day expenses that don’t stop while you’re in the hospital. Cigna Healthcare Hospital Care can provide you and your loved ones with additional financial protection and can help cover these unexpected events – so you can focus on getting better.

What It Is:

A cash benefit paid directly to you1 when you experience a covered hospital3 stay for events such as an in-patient procedure or the birth of a child. This video explains the benefit in more detail.

Benefit Example:

Coverage: Susan elected Hospital Care Insurance

Situation: Susan was hospitalized following a car accident2

Susan’s Covered Benefits:

- Hospital admission

- Hospital ICU stay

- Hospital stay

Critical Illness Benefit: $2,000 paid directly to Susan

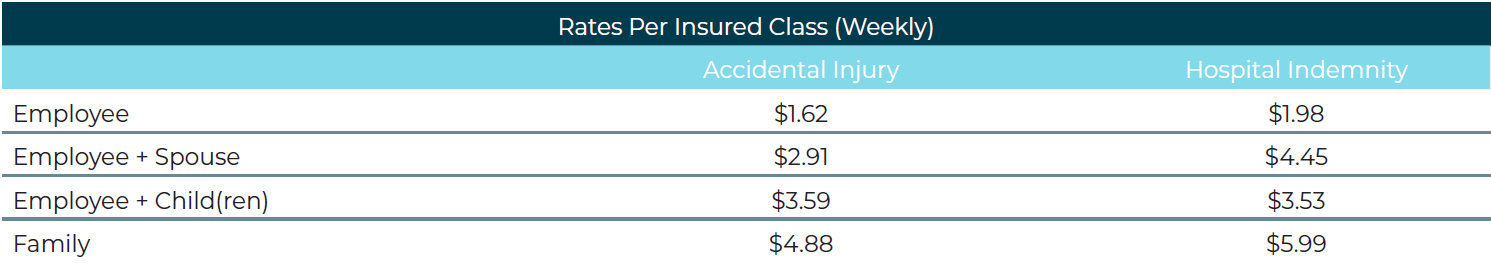

Hospital Care Premiums:

Costs are subject to change. Actual per pay period premiums may differ slightly due to rounding.

All Cigna Healthcare Supplemental Insurance Plans

Key Features to Consider:

- Flexible. Use the money however you want. Pay for anything, including medical deductibles, childcare, transportation, and more. It’s up to you.

- Supplement your medical plan. Benefits are paid in addition to other coverage you may have.

- Cost-effective. Your premium is conveniently deducted from your paycheck at a low group rate.

Easy Access to Your Benefits:

- Submit your claim online on myCigna.com® or on SuppHealthClaims.com.

- Cigna Healthcare reviews your claim.

- Benefit payment is sent directly to you.1

- Benefits may be paid directly to you or anyone you designate, such as a hospital, upon assignment.

- This is an example used for illustrative purposes only. Your plan’s actual costs and benefit amounts may vary. Exclusions and limitations apply.

- The term “hospital” does NOT include a clinic, facility or unit of a hospital for: (1) Rehabilitation, convalescent, custodial, educational, hospice or skilled nursing care; (2) the aged, drug addiction or alcoholism; or (3) a facility primarily or solely providing psychiatric services to mentally ill patients.

- This is an example used for illustrative purposes only. Your plan’s actual costs and benefit amounts may vary. Exclusions and limitations apply.

Supplemental Health Resources

Additional Critical Illness, Accidental Injury and Hospital Indemnity plan details including exclusions and limitations can be found here.

Cigna Healthcare – Summary of Benefits (Critical Illness Insurance)

Cigna Healthcare Critical Illness Premiums

Cigna Healthcare – Summary of Benefits (Accidental Injury Insurance)

Cigna Supplemental Health – CI Wellness Benefit

Cigna Healthcare – Summary of Benefits (Hospital Care Insurance)

Cigna – How to File a Claim

Cigna - Healthcare Supplemental Health Solutions Limitations and Exclusions

Cigna - Ben Admin Enrollment Platform Content AI, CI, HC

Cigna - Customer Video Links

Cigna Healthcare - Accidental Injury and Critical Illness Benefit Guide

Cigna Healthcare - Hospital Care Benefit Guide